Bank details

Bank details

As part of a transaction, capturing accurate bank details is crucial in ensuring timely payment for customers.

case study : Bank details

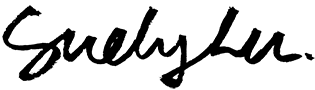

The Grants and Rebates team at Service NSW disburses funds to eligible NSW citizens via a digital application process. Providing timely payments, particularly in times of disaster can have a big impact on customers’ livelihoods.

Customers are asked to provide their bank details as part of the Service NSW digital transaction. Providing incorrect bank details is a time consuming mistake for not only customers but also contact centre staff who field enquiries from customers about payment issues.

duration

2 months along with other priorities

Tools

Figma, workshop facilitation, user testing

My ROLE

As a Senior Product Designer in the team, I led the discovery, research and implementation of the updated bank detail screens.

The problem

As part of the Grants and Rebates strategy we were looking at ways we could enhance the customer experience for the Flood disaster grant application. Payment issues stood out as a big pain point for it’s impact to customers and also the cost to Service NSW to investigate and re-process payments.

Discovery

Our process at Service NSW follows a Double Diamond approach incorporating the key phases of Discovery, Definition, Ideation and Implementation. As part of discovery we conducted the following activities:

Compared designs and learnings between previous and existing Service NSW transactions.

Reviewed existing research that had been conducted looking for common themes around Bank details.

Reviewed how other organisations were capturing bank details.

Potential solutions

Once we understood the core problems related to bank detail issues. I worked with my team to ideate potential solutions that could reduce Bank detail errors, which included:

Allowing customers to save their bank details for reuse.

Allowing customers to update their bank details after application submission.

Presenting a warning to customers to remind them to check their details.

Adding a bank details confirmation page.

Adding BSB validation to the form.

As part of defining the solution we decided to focus on what we could control within our Grants and Rebates remit and start with UI enhancements to the bank details section of the application. Solutions that involved collaboration with teams such as Privacy and MyAccounts would be out of scope for the first enhancement due to conflicting priorities.

I mocked up some designs and shared them with our Principal Inclusion & Accessibility Specialist and our Global Experience Language team to get feedback on what was and wasn’t working.

Validating the designs

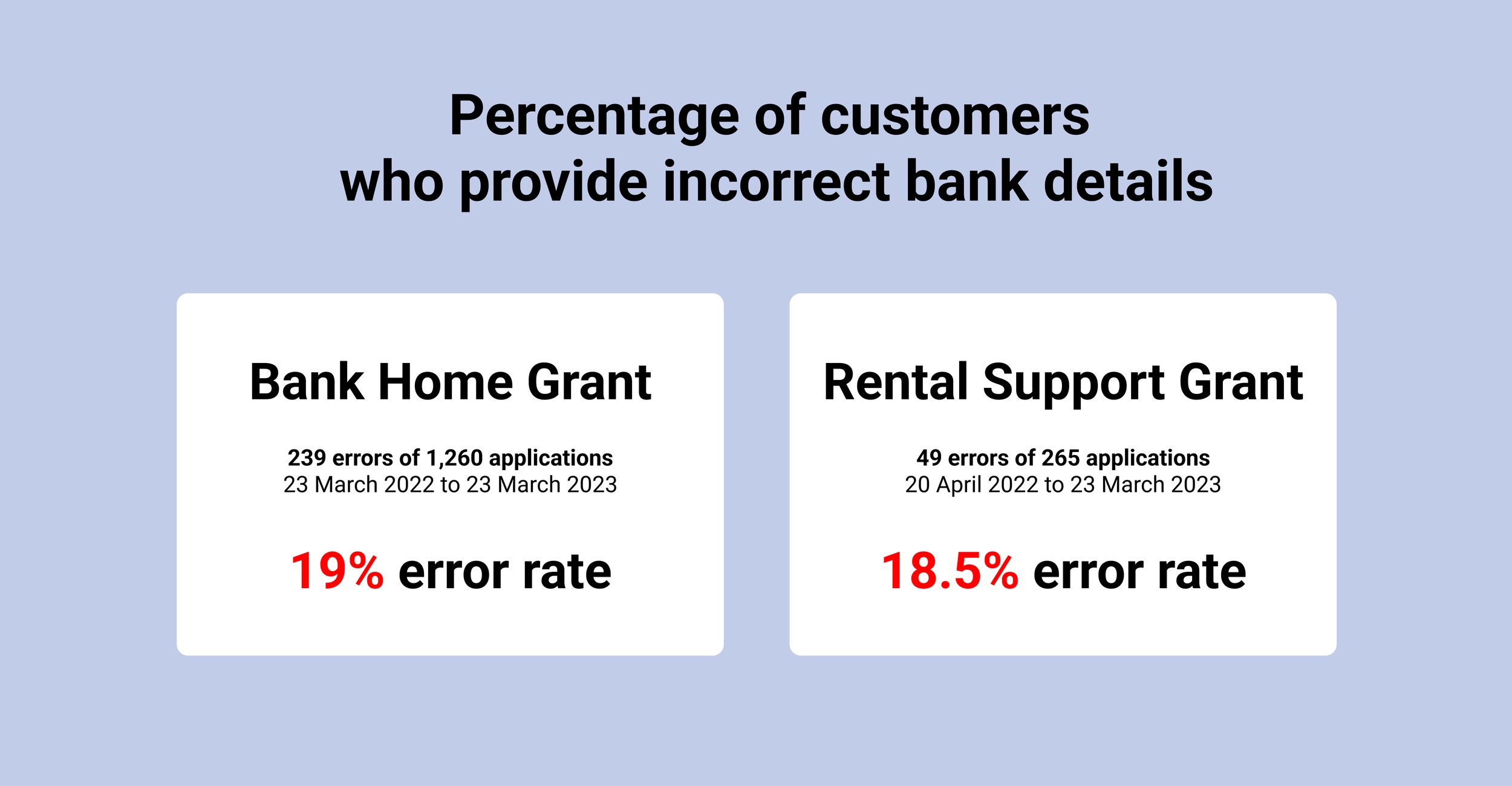

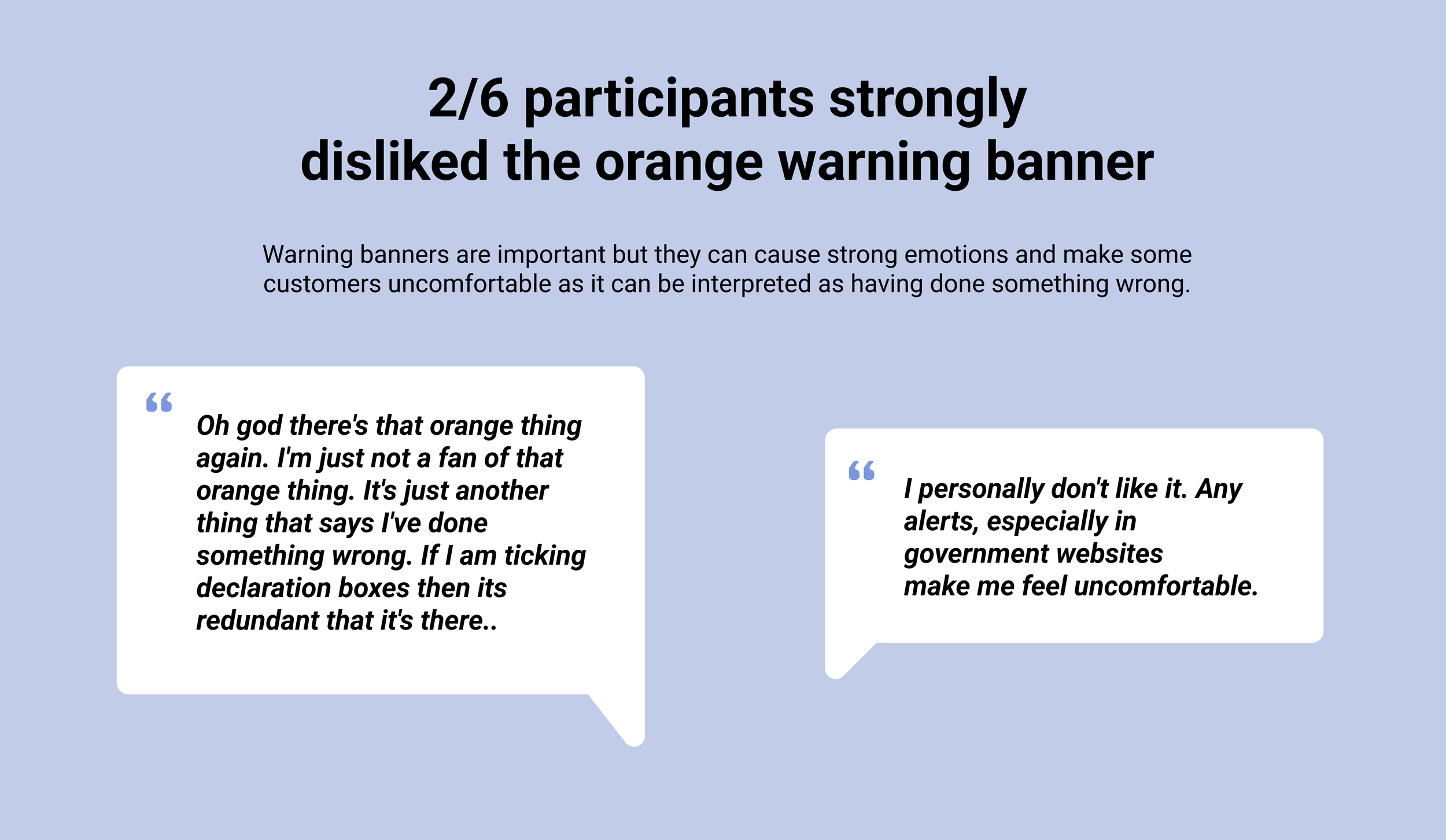

In order to validate the designs, we conducted an A/B test with 6 participants to test two variations of the Bank details page.

The aim of the testing was to validate which designed customers preferred and why .

Option A - Use of a warning message to remind customers to check their bank details and advise that supplying incorrect bank details will delay their application.

Option B - Add a confirmation screen for customers to confirm/check their bank details before continue with the application.

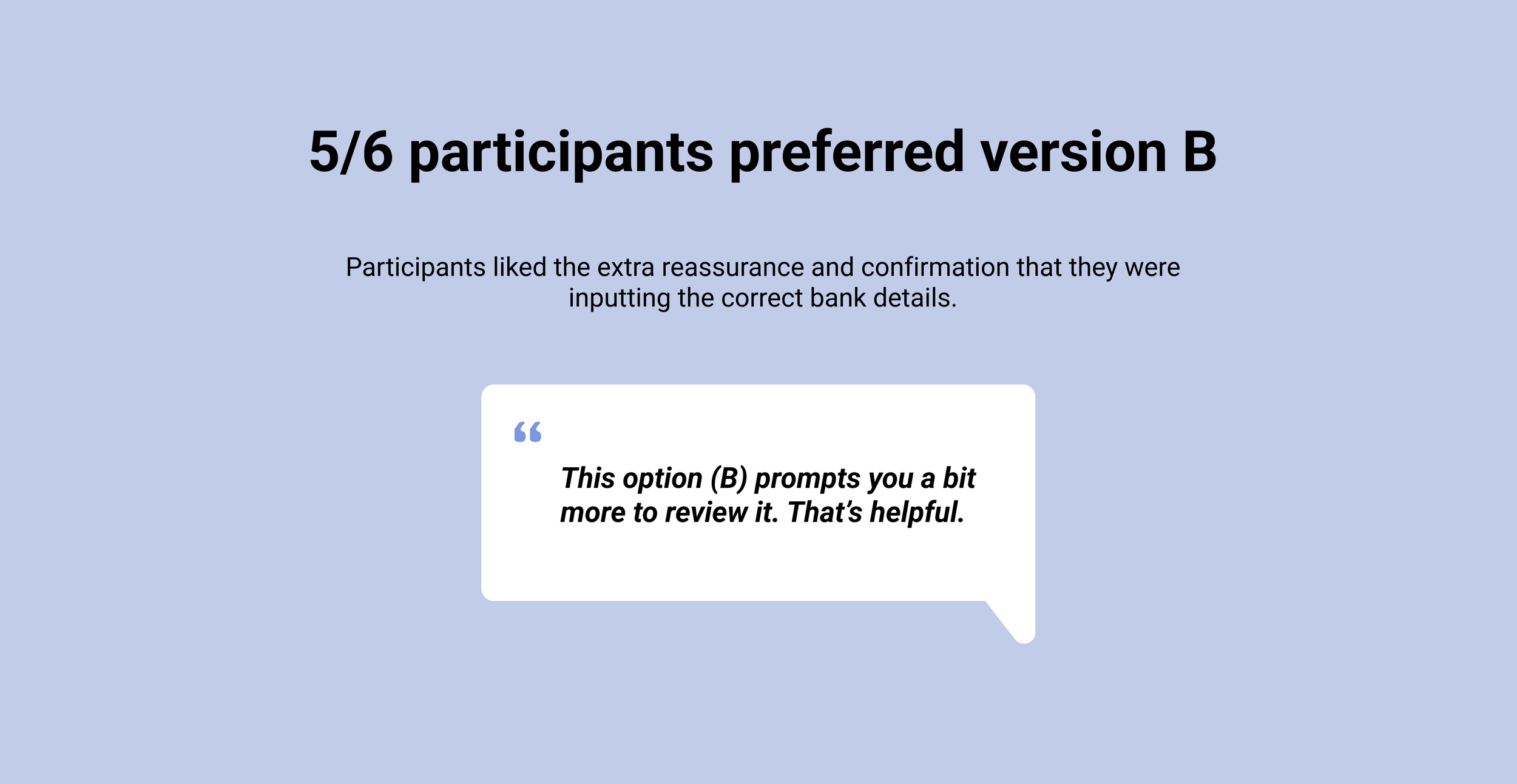

Key insights from testing

Developing the designs

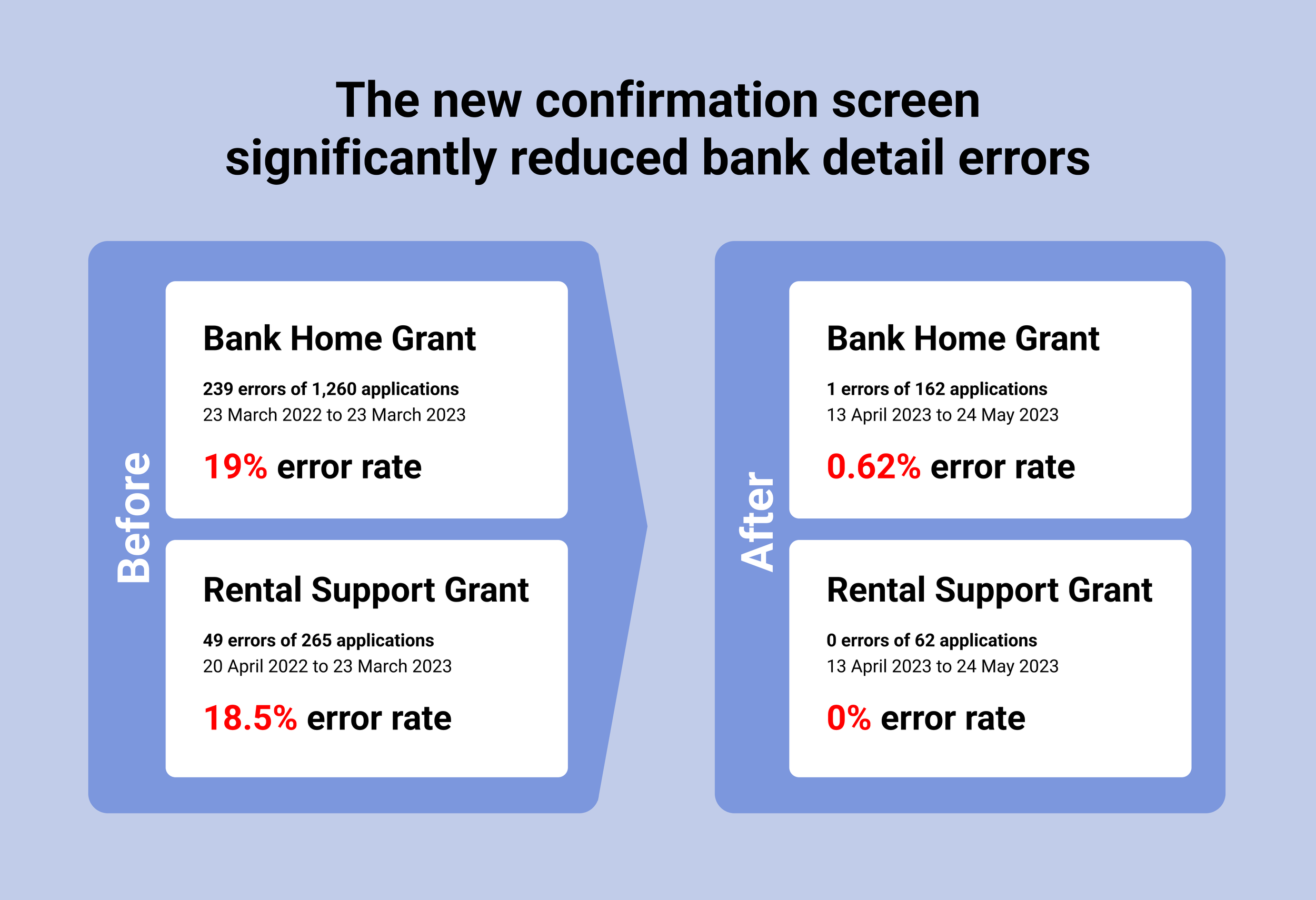

Based on customer feedback we went with the additional confirmation page. I worked with product team (engineers and Product manager) to slice up and prioritise the work along with other priorities.

Results

key takeaways and next steps

Before jumping into solutions, it's crucial to understand the problem from various perspectives to ensure you are not developing something that doesn't address the core issue. Problems often have multiple solutions, and a bias towards action allows us to prioritise immediate successes while also strategically focusing on addressing underlying causes.

Next steps include:

Continue to monitor bank issue error rates

Work on developing additional functionality

Enable customers to independently update their bank details in their SNSW Account and securely store this information for future transactions - in order to prevent bank detail issues in subsequent transactions

Validate account number and BSB input in real-time to prevent errors as customers enter their details - this would require integrations with APIs to confirm if an account number and BSB exist.